By Peter Olorunnisomo – Against the intervention of interests of the African Union and the concerted efforts of African states in courting foreign intervention to build effective trade relationships and attract foreign investors for infrastructural development, it is clearly evident that the spate of external borrowings has increased in Africa and seems to have shifted borrowing homes from the west to the east.

When a few African nations are struggling to cope with servicing their debts portfolio, a notable example is Kenya who owes more to China than it does to Western lenders, the traditional source of loans to Africa.

China interests in Africa also assures throwing open its credit lines to Africa with ‘developmental’ loans that have national value with seeming low interest rates. Analysts warn of the risk of a double-debt stranglehold as African nations plough debts from the west and now from the east.

China has become a generous, ready and easy lender to African countries and a key investor. Researchers say its line of credit to the continent has stretched considerably since 2000 and the money is flowing faster.

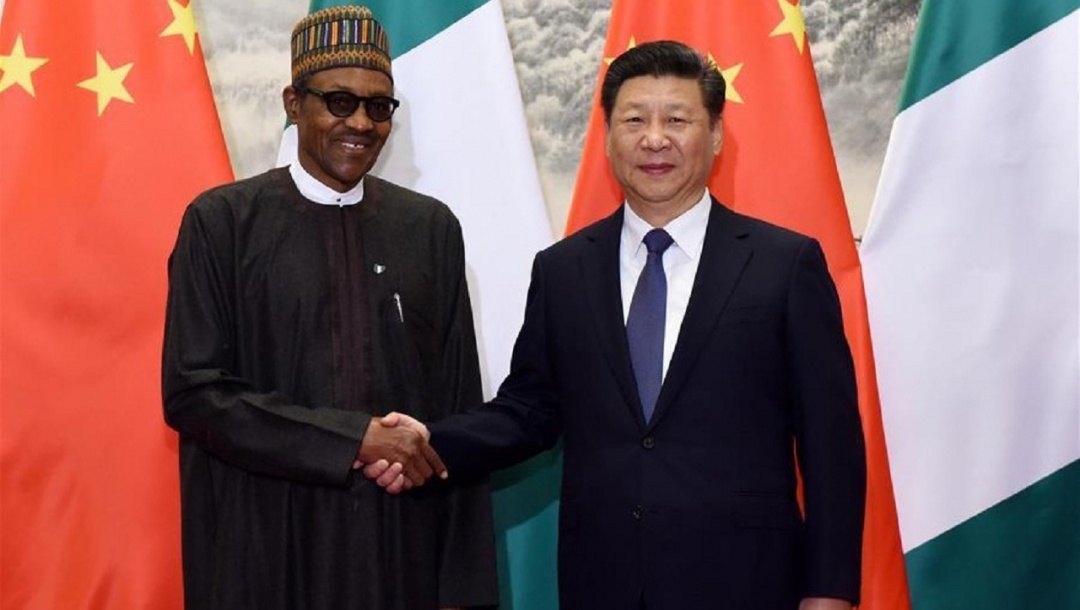

The political expediency that excite the fourth visit of China’s President Xi Jinping to Africa, inked a few more loan deals with Senegal and Rwanda. In South Africa, China’s biggest trade partner in Africa, Xi unveiled a $14.7 billion (€17 billion) investment in its broke national energy utility Eskom and its rail, port and pipeline company.

Beijing’s cumulative loans to Africa since 2000 amounted to $124 billion by 2016, according to figures compiled by the China-Africa Research Initiative (CARI) at Johns Hopkins University School of Advanced International Studies in the United States.

“Half of those loans were given in the past four years,” Janet Eom, an associate researcher at CARI, told DW. “So Africa’s debt to China is becoming more of a concern moving forward.”

Angola, Ethiopia, Sudan, Kenya and the Democratic Republic of Congo respectively, were the top beneficiaries of these loans. Angola’s oil-related loans worth $21.2 billion since 2000 total roughly a quarter of cumulative Chinese loans to the entire continent.

Kenya, by comparison, received $5.2 billion dollars. Its public debt reportedly stands at $50 billion, with 72 percent owned by China. The East African state has a reputation for borrowing from Peter to pay Paul.

The shift in Kenya of a debt stranglehold by international lenders in the West to China, has fuelled the inclination to believe that Africa is heavily indebted to China. Analysts say that is hardly the case, however.

In the decades since independence, African countries have struggled to secure loans for infrastructure and industrial development. The loans offered by former colonial powers and the World Bank or the International Monetary Fund (IMF) came with high interest rates and many restrictions.

Then came the era when these developmental loans were now sourced from the world’s ‘high street’ lenders. The Paris and London clubs became the reality of the moment and the vice grip of their terms cannot also be negated. Nigeria was one of a case in point that was able to escape from the stranglehold and it the technical acumen Ngozi Okonjo-Iweala (then straight out of the World Bank as Nigeria’s Finance Minister) and the political will of ex-President Olusegun Obasanjo to come out of that debt.

China stepped into the breach with loans that set fewer conditions. But only a portion of Africa’s overall debt is actually owned by China, analysts say.

“African debt is not yet as high with China as compared to its debt to industrial countries like the European Union or countries like France, Great Britain or the US,” said William Gumede, Professor of Public Management at the University of the Witwatersrand and Chairman of the Democracy Works Foundation in South Africa.

“More than 50 percent of African countries owe debt either to the former colonial powers or to multilateral organizations like the World Bank and the IMF.”

Chinese direct foreign direct investment in Africa still outweighs its loans, said Eom, citing a CARI estimate of $210 billion. “But this figure is less reliable,” she said.

This is in part because Chinese loans are channelled to African governments and state-owned enterprises via a complex development finance matrix of Chinese banks, companies and contractors. The transactions don’t always involve the disbursement of absolute cash sums.

“Most of the loans are for transport infrastructure, such as roads, railways and ports,” Eom said. Not all recipients are resource-rich countries.

When African countries look for a loan or funding, they often want it quickly because they may have an emergency or an immediate problem. It can take up to two or three years for lending institutions to approve a loan.

“It appears quicker to get a loan from China. The Chinese are saying their loans are cheaper than say the loans from the World Bank or developed countries. It’s not entirely true – it’s half true,” said Gumede.

“When they make a loan they don’t demand that African countries follow their policies, although they do immediately demand that African countries support mainland China and not the Republic of China – Taiwan,” said Gumede.

China considers Taiwan a breakaway province, while Taiwan regards itself as a sovereign state.

It is increasingly common in countries like Angola, Mozambique or Ghana, which benefit from Chinese loans for infrastructure, to see Chinese trucks and workers.

“The Chinese do often insist that their equipment is used and often also their people. Workers from rural areas of China, who would otherwise be unemployed in China, now come and work on these projects,” Gumede said.

“If African countries are not careful, over time the debt that they have to China is going to be the equivalent, or even more than, the debt that they have to industrialized countries and to the World Bank,” said Gumede.

“If they don’t use the loans for those purposes, Africa will fall into double debt to China and the colonial powers.”

There have already been cases where African countries have defaulted on debt to China, says Eom. But Beijing is more likely to re-negotiate the terms of a loan than cancel it entirely. A case in point is Zimbabwe under Mugabe in the 1990s and it has taken China over 20 years to find belief in over-riding that incident of payment default to now resume loan ties with Zimbabwe.

And when China did decide to facilitate loans, the restrictions were tough: Chinese companies wanted to be exempted from local labour laws and given the first rights to mineral exploration. “Some mineral rights were almost sold off to the Chinese as part of the loan,” said Gumede.

“Kenya may have a harder time because Chinese banks expect loans to be repaid,” she said.

Both Eom and Gumede cite the example of Zimbabwe.

Experts agree that the ability of African countries to service their debts to China strongly depends on economic performance and whether the money that has flowed in is used for infrastructure and projects that can boost new business or spin income.

Kindly follow us on twitter:@AfricanVoice2