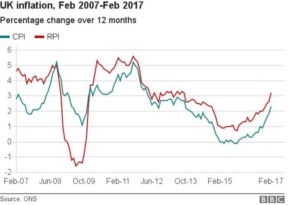

The UK’s key inflation rate hit its highest for more than five years in September, driven up by increases in transport and food prices.

The Consumer Prices Index (CPI) climbed to 3%, a level it last reached in April 2012, and up from 2.9% in August.

The Consumer Prices Index (CPI) climbed to 3%, a level it last reached in April 2012, and up from 2.9% in August.

The pick-up in inflation raises the likelihood of an increase in interest rates next month.

The figures are significant because state pension payments from April 2018 will rise in line with September’s CPI.

Under the “triple lock” guarantee, the basic state pension rises by a rate equal to September’s CPI rate, earnings growth or 2.5%, whichever is the greatest.

At the moment, the full new state pension is £159.55 per week, equivalent to £8,296.60 per year.

Business rates will go up by September’s Retail Prices Index (RPI) of 3.9%.

The fall in the pound since last year’s Brexit vote has been one factor behind the rise in the inflation rate, as the cost of imported goods has risen.

ONS head of inflation Mike Prestwood said: “Food prices and a range of transport costs helped to push up inflation in September. These effects were partly offset by clothing prices that rose less strongly than this time last year.”

Inflation has hit a five year high and is now 0.9% above the rate of wage growth – meaning that the incomes squeeze is becoming tighter.

And if you are employed in the public sector – where pay rises are capped at 1% – or rely on benefits – which are frozen – that squeeze is even tighter.

With poor economic growth figures and uncertainty over the Brexit process, the Bank of England’s decision on whether to raise interest rates next month is finely balanced.

Yes, “price stability” is the main purpose of the Bank of England’s monetary policy committee which makes the decision.

But many believe that inflation may now have peaked as the effects of sterling’s depreciation following the referendum dissipate.

An interest rate rise now, which increases prices for millions of mortgage holders and could dampen economic activity, could be just the medicine the economy doesn’t need.

The Bank of England is tasked with keeping CPI inflation at 2%, and last month its governor, Mark Carney, indicated interest rates could rise in the “relatively near term” if the economy continued on its current path.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said: “The tick upwards in inflation will increase expectations of a rate rise from the Bank of England later on this year, stoked by a flurry of hawkish rhetoric coming from Threadneedle Street.”

However, he added, it is not a foregone conclusion, “so it’s probably best not to count those chickens until they’re hatched”.

Pensioners will be celebrating again. Today’s CPI inflation figure means they will get a 3% rise next April, their largest pension increase for six years.

Those on the new state pension will see their weekly income rise to £164.

Compare that to workers, who’ve seen their earnings rise by 2.1% over the last year.

This is all thanks to the triple lock, which sees the state pension rise by the highest of earnings, prices or 2.5%.

Food for thought for the chancellor, perhaps, who’s reported to be considering tax concessions for younger people in his forthcoming budget, to even-up the inter-generational unfairness that the triple lock has contributed to.

The 2.5% element of the triple lock is due to be dropped in 2021.

Kindly follow us on twitter:@AfricanVoice2