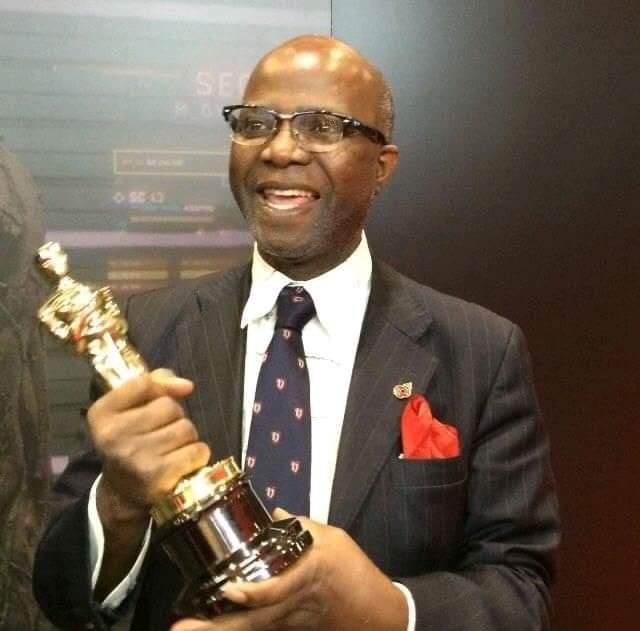

Professor Chris Imafidon, the renowned adviser to monarchs, governments, presidents and corporate leaders reviews the new spending priorities of the government.

INTRODUCTION

The UK’s October 2024 Budget, unveiled by Chancellor Rachel Reeves, has far-reaching implications for employers, employees, migrants, and students. Here’s a breakdown of the key announcements and their potential impact:

Employers

● Increased National Insurance Contributions: Employers will face a 1.2 percentage point increase in National Insurance contributions from April 2025, raising the rate to 15%. This will significantly impact businesses, particularly small and medium-sized enterprises (SMEs).

● Lower Threshold for Employer NI Contributions: The threshold at which employers start paying National Insurance will be lowered from £9,100 to £5,000 annually. This will further strain businesses, especially those with lower-paid employees.

● Tax Thresholds: While tax thresholds will eventually rise with inflation, the freeze on inheritance tax will continue until 2030, potentially impacting estate planning for business owners.

Employees

● Minimum Wage Increase: The national living wage will rise by 6.7% to £12.21 per hour for those aged 21 and over, benefiting lower-paid workers.

● Carers Allowance: Individuals can now claim carers allowance while earning up to £10,000 per year, providing additional financial support to carers.

● Universal Credit Overpayments: A fairer repayment system will be implemented for Universal Credit overpayments, easing the burden on claimants.

Migrants

● No Major Changes: The Budget did not introduce significant changes to immigration policies. However, the economic climate and job market conditions, influenced by the Budget measures, may impact migrant workers’ opportunities.

Students

● Research and Development Funding: The Budget allocated over £20 billion for research and development, including funding for core research in areas like engineering and medical science. This may lead to increased opportunities for students pursuing research-oriented careers.

● Higher Education Funding: While the Budget did not include specific announcements for higher education funding, the overall economic climate and potential changes in student finance could indirectly impact students.

Overall Impact

The Budget aims to balance economic growth with social fairness. However, the increased tax burden on businesses and the potential squeeze on disposable incomes could impact economic activity and job creation. The increased investment in public services and social support could benefit certain sectors and individuals, but the long-term consequences remain to be seen.

Sources:

● HM Treasury: https://www.gov.uk/government/topical-events/spring-budget-2024

● Office for Budget Responsibility: https://obr.uk/

● Institute for Fiscal Studies: https://ifs.org.uk/

● BBC News: https://www.bbc.com/

● Sky News: https://news.sky.com/

Please note: This report is based on the information available at the time of writing and may not reflect all the nuances and potential long-term implications of the Budget. It is recommended to consult with financial advisors and relevant authorities for specific guidance.