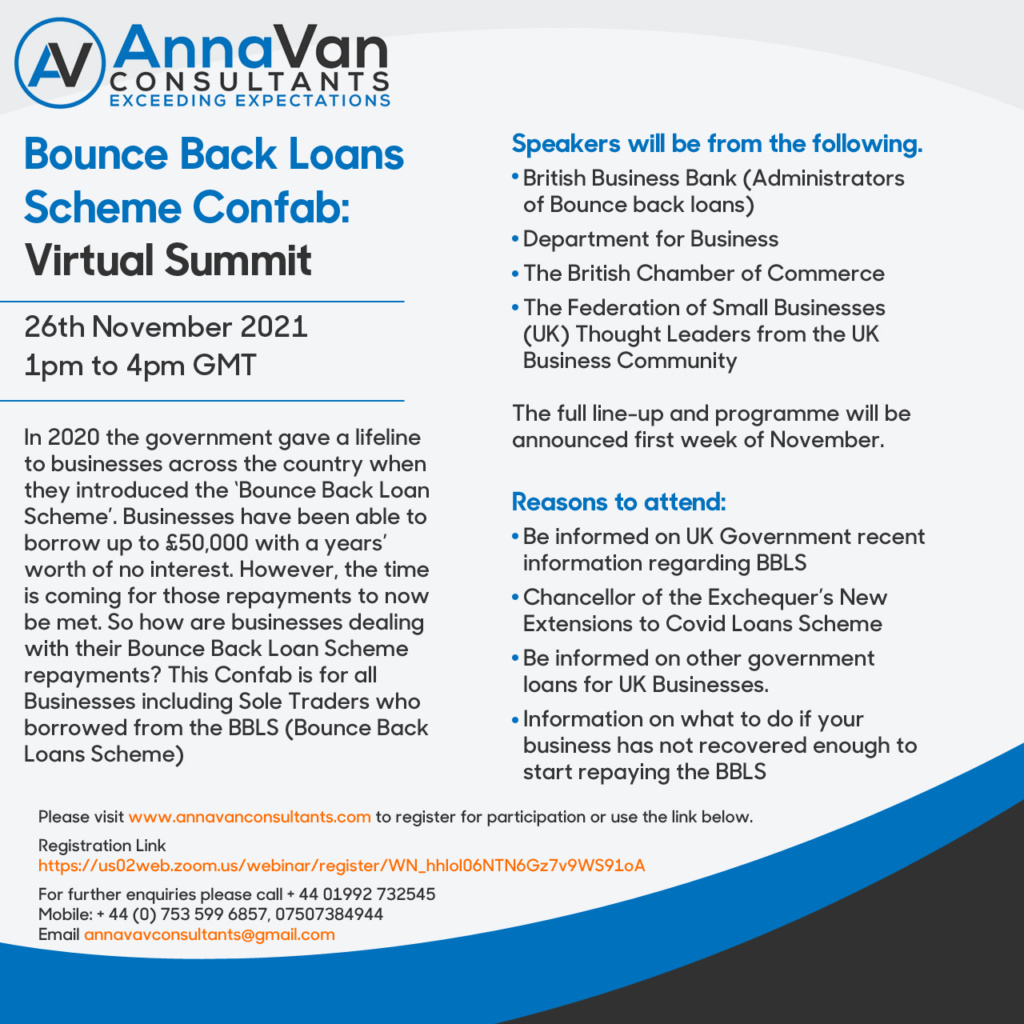

Businesses have been able to borrow up to £50,000 with a years’ worth of no interest. However, the time for repayments are around the corner. A Summit, to help all businesses including Sole Traders will be held virtually on 26th November 2021.

According to analysis by The Resolution Foundation, the Autumn Budget means austerity will be partially reversed by “a third” in 2025. The Autumn Budget, announced on Wednesday, 27 October by Chancellor Rishi Sunak, has been analysed by various experts overnight.

According to the insight of The Resolution Foundation, the proposed funding would only be enough to reverse “a third” of the day-to-day cuts that happened during a decade-long austerity. Real day-to-day spending will also be down 40% in Work and Pensions and Transport. This makes it more imperative that SME’s who took out the BBLs survive the austerity conditions in which they must continue to trade to sustain livelihoods and keep the economy going.

In 2020, The government gave a lifeline to businesses across the country when they introduced the ‘Bounce Back Loan Scheme’. Many Businesses, especially in the BME community have been able to borrow up to £50,000 with a years’ worth of no interest. However, the time is coming for those repayments to now be met. It’s crunch time for many businesses. So how are businesses dealing with their Bounce Back Loan repayments?

The Bounce Back Loans Confab scheduled to hold virtually on the 26th November 2021 explores the impact of Bounce Back Loans now that they have stopped, and repayments are due and how businesses are dealing with their repayments as well as to explore options where repayment is concerned especially whereby cannot afford to meet repayments.

For those companies who are struggling and as a result of non-payments will find their Directors blacklisted from serving in the UK as Company Directors, There are ways to mitigate the issue. Knowledge is power, so the organisers of the Confab are keen to have businesses on board.

The Bounce Back Loan schemes have been a great aid, but to some degree they have also added more pressure onto businesses as the time comes for repayments. But if directors can hold on and are able to service the loans, there’s a great chance that the BBL will have done their job, helping businesses survive.

To register and participate, please visit, annavanconsultants.com or register via link below.

Registration Link

us02web.zoom.us/webinar/regist[ … ]NTN6Gz7v9WS91oA

Kindly follow us on twitter:@AfricanVoice2