Some 16 African government and business leaders that include Nigeria’s President, Muhammadu Buhari, South Africa’s Cyril Ramaphosa, Egypt’s President Abdel Fattah Al-Sisi and Kenya’s Uhuru Kenyatta arrive in London to attend the UK-African Investment Summit 2020 this weekend.

The UK-Africa Investment Summit 2020 that is taking place on Monday 20 January brings together businesses, governments and international institutions across Africa to interact, grow and explore new business opportunities.

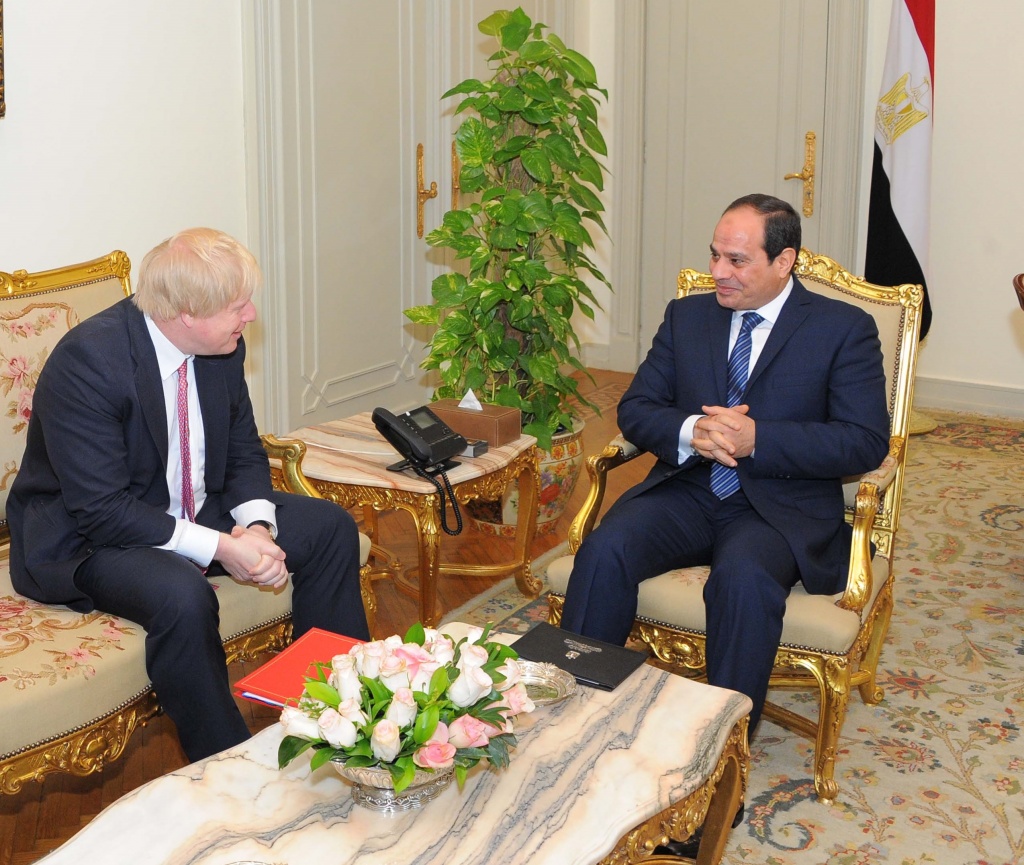

The Summit that will be hosted by UK Prime Minister Boris Johnson will expose African businesses to global trade and help to drive economic growth as well as reduce poverty.

The Foreign Secretary said, exclusively to African Voice: “As we leave the EU, our vision for Global Britain is that of a good and equal partner. And Africa is key to that vision. We turn to the nations of Africa to renew our relationships and build closer trading partnerships. And we want to help them grasp new investment opportunities. Today, African countries receive less than 4% of global foreign direct investment. That needs to change.

“Africa’s population is one of the youngest in the world. There’s a vibrant middle class, and one of the world’s fastest-growing telecoms sectors. These thriving, rapidly growing populations provide new, exciting opportunities for UK and African businesses to trade and invest.

“The UK-Africa Investment Summit will create new and lasting partnerships that will deliver more investment, jobs and growth, benefitting people and businesses across Africa and the UK.

“This Summit will allow us to build on the genuine friendships that can unleash Africa’s potential.”

The International Development Secretary, Alok Sharma announced on Friday 17 January 2020 that UK Government will be supporting City of London to mobilise billions of pounds of investment to transform Africa.

More African businesses are listed on the London Stock Exchange than any other finance centre outside the continent. But African assets still only account for around 1% of total investments managed by the City.

Today’s announcements will help more money from private investors like pension funds flow into Africa by making it easier, quicker and more secure to invest. This will also ensure that money is going directly to support green and sustainable development.

The three new initiatives, backed by almost £400 million of UK aid support, include:

- Extra support to the UK’s Financial Sector Deepening Platform which will improve the financial systems and regulations of 45 developing nations in Africa, to build more confidence for international investors; lead the way to boost green finance products and improve access to bank accounts and loans for African entrepreneurs.

- Collaboration with the City of London on a competition for fund managers to identify new investment products for Africa, which could be listed on major stock exchanges like London, making it easier and more appealing for global investors to put money into African projects at scale.

- A new facility with the World Bank’s International Finance Corporation (IFC) to develop more local currency bonds, allowing businesses and governments in Africa to raise investment in their own currencies and reduce the risks and costs associated with borrowing in foreign currencies, because of potentially damaging exchange rate fluctuations. This will help African countries better plan and invest in their future.

International Development Secretary Alok Sharma said:

Africa’s substantial investment potential is clear, with many African countries outstripping global economic growth in recent decades. The UK is already the top financial exchange for Africa’s businesses and we want investors to seize the exciting opportunities that Africa offers.

These new initiatives, announced ahead of the UK-Africa Investment Summit, will make it easier, greener and more secure to invest in Africa, mobilising billions of pounds of sustainable investment to help end poverty.

These announcements come on the same day that a new World Bank International Development Association (IDA) Sterling bond will be listed on the London Stock exchange, which is expected to raise hundreds of millions of pounds for high impact investment across Africa.

President of the World Bank Group David Malpass said: By 2050, one in four global consumers will be African. But Africa currently attracts less than 4 percent of global Foreign Direct Investment. Strong actions from countries to improve rule of law and take on vested interests could create the right incentives to spur investment by strengthening financial systems, building confidence in financial markets, and enabling more productive private sector activity.

On behalf of the World Bank Group, I’d like to thank the UK government for their leadership in supporting investments in Africa. Working together with us in global cooperation, the countries of Africa can meet their ambitions to boost growth, create jobs, and lift people out of poverty.

Minister for Investment Graham Stuart said: The UK’s position as a world centre for finance makes it well positioned to support increased private sector investment into Africa, creating more jobs, driving economic growth and financing vital infrastructure projects. Today’s announcements are a brilliant step forward in supporting that objective.

Kindly follow us on twitter:@AfricanVoice2