Money transfer operators in the UK have come together to commit towards permanently lowering the cost of remittances by launching the first World Money Transfer Day on Sunday, 15th March 2015 in an attempt to reverse the perceived rip-off in a traditionally uncompetitive and non-transparent industry.

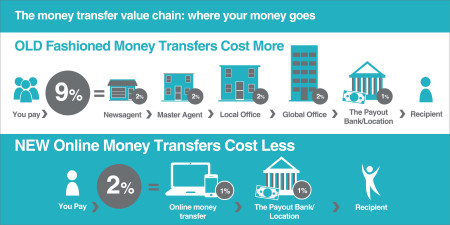

The global leaders in the business and high street banks, who dominate the industry, currently charge an average of 8-10 per cent on money transfers and in some corridors over 20 per cent. But with the entry of new online money transfer services, customers are changing how they choose to send their money home causing fees to gradually come down.

To affect change and achieve fairer charges for remittances, an increasing number of people are signing petitions online to reduce the fees payable on money transfers to zero. According to campaigners at Stop The Transfer Tax Rip Off, led by Tessa Jowell MP:

“Every day, thousands of Londoners send money to their mothers, fathers and other relatives in developing countries to fight poverty. But money transfer companies take up to a fifth of all the money intended to support their families through fees and unfair currency exchange rates. This is money that should go to pay for girls to go to school or grandmothers to visit a doctor.

“Reducing these fees could make a huge difference. If the cost of sending money overseas were reduced by just 5 per cent, developing countries would receive over £10 billion each year more than they do now. That is nearly as much as the UK spends on development aid.

“The G8 committed to cutting transfer fees to 5 per cent by last year, but families are still being ripped off. Sending money to some parts of the world can cost up to 20 per cent, which is exploitation pure and simple.

“Technological innovation is already transforming the financial sector in many countries; but too often the benefits are not available to the poorest.”

In a poll of 2,000 respondents conducted prior to World Money Transfer Day, customers decided on 2.4 per cent as a ‘fair’ fee to charge for a money transfer.

This campaign to reduce high money transfer costs enjoys the support of the diaspora community, the ethnic media in the UK and leading inter-governmental organizations such as the International Organisation for Migration (IOM). According to The World Bank, money transfers support the welfare of an estimated 700 million people globally.

Speaking at a press conference to mark the launch of World Money Transfer Day, IOM United Kingdom Chief of Mission Clarissa Azkoul said: “IOM supports and seeks to promote innovative remittance mechanisms which reduce the cost of money transfer for migrants. The hard-earned money that migrants send every day to their loved ones back home represents a vital economic lifeline and should be maximized to the extent possible.”

In his contribution, another guest speaker, Onyekachi Wambu, Director of AFFORD UK said, “With over 245 million migrants and diasporans sending half a trillion dollars to their countries of origin, their efforts at impacting lives should not be undermined by high charges. The contributions of these migrants, some of whom are cleaners and taxi drivers, are much higher than Overseas Development Aid.”

Mobiles emerge as a player

Almost one in ten 18 – 24 year olds (eight per cent) have sent money via a mobile phone or app, compared to less than one in a hundred over 55s. Data from Azimo, a leading online service provider shows that the percentage of transactions sent from a mobile device more than doubled in the previous 12 months to January 2015.

Migrant customers are increasingly looking for multiple options for collecting their money. Around 40 per cent would like to be able to pick-up cash; a similar number would like to send money to a bank account while only five per cent are interested in receiving money using a mobile wallet on a smartphone.

In an interview with African Voice, Michael Kent, CEO of Azimo, said to aid development in some of the countries the company, as part of its corporate responsibility, charges transfers at cost price.”

He said, “Azimo is the cheapest and easiest way to send money to 198 countries across the world; from your smartphone, tablet or desktop and even through Facebook.”

Marta Krupinska, Co-Founder and General Manager at Azimo said, currently with every transaction Azimo gives the customer the opportunity to donate one pound to a cause in partnership with a charitable organization.