By Finnigan Wa Simbeye

Local sugar producers are heading into rough waters as the annual sugar quota which allowed them export to the European Union (EU) comes to an end in 2017.

Since 2007, the EU has been reforming its Sugar Protocol regime as part of directives by the World Trade Organisation (WTO) to end its heavily subsidised European Common Agriculture Policy.

The annual EU sugar exports used to be an important hard currency earner for the country as the commodity fetched premium prices almost double the world market prices.

Euros earned from over 20,000 metric tonnes of sugar exports per annum to the EU enabled local sugar industries to expand their production by importing machinery and repair parts which played a significant role in boosting production which now stands at about 300,000 metric tonnes.

Under pressure from some members of the WTO led by the United States, which complained against preferential trade treatment between the EU and African, Caribbean and Pacific (ACP) members, Brussels and its ACP partners have been forced to end their trade arrangement.

Crafted in June 2000 through the Cotonou Partnership Agreement, the EU/ACP trade deal succumbed to WTO censure and was forced to start a different arrangement known as Economic Partnership Agreements (EPAs). The new arrangement has met stiff resistance from some of the ACP members who were split in regional blocs by the European Commission (EC), which argued that it would be much more efficient to negotiate through regional blocs other than with ACP as a single bloc.

Tanzania, which started negotiating EPAs under the Southern African Development Community (SADC), decamped a few years later after South Africa ignored other SADC members and went on to sign an EPA with the EC (executive arm of the EU).

South Africa, which by any standards is a middle income economy, has a lot to trade with the EU compared to Tanzania and other smaller ACP economies, hence was obliged to decamp and seek a much more suitable group with similar characteristics. The East Africa Community (EAC) was Dar es Salaam’s ultimate choice after Kenya and Uganda, which initially wanted to sign an EPA under Common Market for Eastern and Southern Africa, decamped to the sub-regional bloc.

Under the controversial EPAs, the initial idea as per WTO rules was to remove preferential trade treatment between ACP and EU countries which discriminated against other members of the global trade body’s over 140 countries.

In addition, EPAs sought to introduce trade reciprocity, which means if Brussels allowed ACP commodities entry into its market duty free, the same should be granted to EU exports into ACP markets. It spelt a disaster.

Much of the ongoing debate between the EC and EAC bloc over EPAs is mainly centred on this and other similar trade details like Singapore Issues (liberalised trade in services, etc).

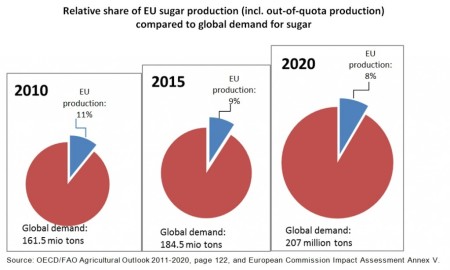

Last week news came out that the EU will start exporting sugar to the Middle East and Africa come 2017. According to Reuters, the EU is expected to end sugar production quotas – currently at some 14 million tonnes per year – as part of reforms to create a freer sugar market.

Analysts said the volume of EU sugar exports after the lifting of quotas would be linked to growers’ assessments of international sugar prices relative to alternative crops such as grains, as well as production and freight costs. Some analysts said they believed the EU had the potential to export some 2 million tonnes a year after quotas are lifted.

Although the EU expects to export mainly industrial sugar, which the country does not produce, the idea of changing its sugar regime under WTO raises enough eyebrows among Least Developed Countries (LDC), which since 2000 have opposed any new global Trade Round under Doha Process.

The LDC group is worried that EPA are meant to achieve what has stalled at WTO through the back door because, as a bloc, ACP has more than 70 members who add up to over 100 if joined by the EU’s 28 members.

With over 100 combined members, the EU/ACP trade arrangement is enough to push through stalled global free trade talks at WTO where another significant number of American and Asian countries are backing the move.

Industrial sugar from Europe will be the first product to open up the African market for heavily subsidised European sweetener with many others likely to follow.

In the long run, Africa will become a department mega shop for not only EU producers, but also other heavily subsidised American and Asian producers who will qualify for duty free exports under WTO’s non- discriminatory rules.